How to Apply Mudra Bank Loan Yojana (PMMY) Loan: Mudra (or) Micro Units Development & Refinance Agency Limited is an institution set by the government of India for the developing the refinancing relating small business. This mudra loan was announced by our honorable finance minister in 2016. Under this mudra, loans are provided 3 schemes namely: ‘Shishu’, ‘Kishor’ and ‘Tarun’.These 3 schemes are helpful for small micro units and Entrepreneurs in India. We provided complete information on "How to apply mudra bank loan Yojana", " How to Apply for Mudra Bank Loan online & offline methods". Below we are provided complete information on Mudra Bank Loan Yojana.

1)Shishu: Loan of up to Rs.50,000/=

2)Kishor: Loans of above Rs.50,000 to Rs.5 lakhs.

3)Tarun: Loans of above Rs.5 lakhs to Rs.10 lakhs.

The target audience for MUDRA loans are millions of Proprietorship / Partnership Firms running a small manufacturing unit or service sector units like shopkeepers, fruits/vegetable vendors, truck operators, food service units, repair shops, machine operators, small industries, artisans, food processors and others, in rural and urban areas.

Mudra Loan is provided by the Mudra ATM Card. Borrowers can take the money for their business requirement from the ATM centers also. MUDRA card also allows for repayment of the amount as and when the surplus is available, thereby reducing interest burden. This type of facility is very helping for small business. Once this MUDRA atm card received from the bank. Then we can easily take money from ATM Centers. Mudra ATM Card works like a credit card with a low-interest rate.

2)Approach Banks / Financial institutions: The borrowers can approach one or more banks (or) Financial institutions offering MUDRA Loan.

3)Loan Processing: The bank (or) Financial institutions will process MUDRA Loan application as per their terms and conditions.

4)Loan Sanctioning: If the loan application is accepted, the bank or financial institution will sanction the loan and provide the MUDRA Card.

The borrower can approach the branch of a bank or financial institution providing MUDRA loan with the following documents and information.

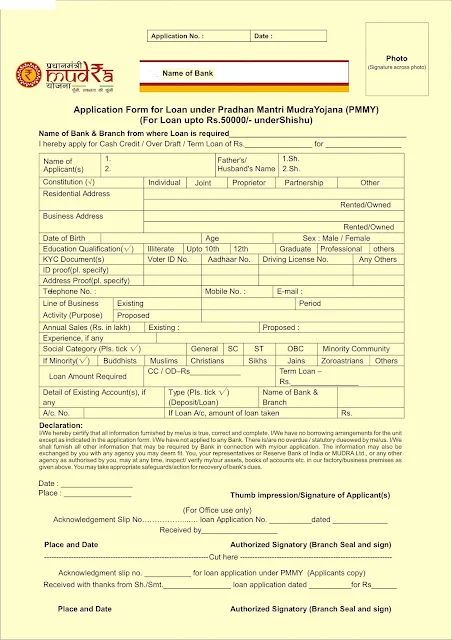

1)MUDRA Loan Application

2)Business plan

3)Proof of Identities like PAN / Drivers License / Aadhaar Card / Passport and more.

4)Residence proof like recent telephone bill/electricity bill or property tax receipt and more.

5)Applicant’s recent photograph less than 6 months old

6)Quotation of machinery or other items to be purchased

7)Name of supplier or details of machinery or prices of machinery

8)Proof of identity/address of the business like tax registration, business license and more.

9)Proof of category like SC/ST/OBC/Minority, if applicable

NOTE: There is no processing fee or collateral requirement for obtaining MUDRA loan.

Below we have provided the top banks and Financial Institutions providing MUDRA Loan. You can contact one or more of the following financial institutions with the relevant documents for obtaining MUDRA loan.

1)Punjab National Bank

2)Bank of Baroda

3)Central Bank of India

4)Allahabad Bank

5)UCO Bank

6)State Bank of India

7)Canara Bank

8)Bank of India

9)Syndicate Bank

10)Indian Bank

1)HDFC Bank

2)IndusInd Bank

3)Axis Bank

4)ICICI Bank

5)Ratnakar Bank

6)Yes Bank

7)Karnataka Bank

8)Karur Vysya Bank

9)South Indian Bank

10)Lakshmi Vilas Bank

1)Uttar Bihar Gramin Bank

2)Pragathi Krishna Gramin Bank

3)Karnataka Vikas Grameena Bank

4)Kerala Gramin Bank

5)Madhya Bihar Gramin Bank

6)Baroda UP Gramin Bank

7)Baroda Rajasthan Ksethriya Gramin Bank

8)Andhra Pragathi Gramin Bank

9)Pallavan Grama Bank

10)Allahabad UP Gramin Bank

How to Apply Mudra Bank Loan Yojana

Loans under Mudra

1)Shishu: Loan of up to Rs.50,000/=

2)Kishor: Loans of above Rs.50,000 to Rs.5 lakhs.

3)Tarun: Loans of above Rs.5 lakhs to Rs.10 lakhs.

Eligibility For Mudra Loan

To apply for this "Mudra Loan" any Indian citizen are eligible to apply for this loan. Who is planning to start the small business, in between any financial support to make growth for the business. The Indian government has implemented this scheme for helping micro units business. Any banks can give the loan maximum 10 lakhs based on the business investment.The target audience for MUDRA loans are millions of Proprietorship / Partnership Firms running a small manufacturing unit or service sector units like shopkeepers, fruits/vegetable vendors, truck operators, food service units, repair shops, machine operators, small industries, artisans, food processors and others, in rural and urban areas.

MUDRA ATM Card

How to Get MUDRA Loan

Steps for getting MUDRA Loan

1)Prepare Documents: The borrowers must prepare the business plan and required documents as per check list.2)Approach Banks / Financial institutions: The borrowers can approach one or more banks (or) Financial institutions offering MUDRA Loan.

3)Loan Processing: The bank (or) Financial institutions will process MUDRA Loan application as per their terms and conditions.

4)Loan Sanctioning: If the loan application is accepted, the bank or financial institution will sanction the loan and provide the MUDRA Card.

The borrower can approach the branch of a bank or financial institution providing MUDRA loan with the following documents and information.

1)MUDRA Loan Application

2)Business plan

3)Proof of Identities like PAN / Drivers License / Aadhaar Card / Passport and more.

4)Residence proof like recent telephone bill/electricity bill or property tax receipt and more.

5)Applicant’s recent photograph less than 6 months old

6)Quotation of machinery or other items to be purchased

7)Name of supplier or details of machinery or prices of machinery

8)Proof of identity/address of the business like tax registration, business license and more.

9)Proof of category like SC/ST/OBC/Minority, if applicable

NOTE: There is no processing fee or collateral requirement for obtaining MUDRA loan.

Top Banks and Financial Institutions providing MUDRA Loan

Below we have provided the top banks and Financial Institutions providing MUDRA Loan. You can contact one or more of the following financial institutions with the relevant documents for obtaining MUDRA loan.

Top 10 Public Sector Banks providing MUDRA Loan

1)Punjab National Bank

2)Bank of Baroda

3)Central Bank of India

4)Allahabad Bank

5)UCO Bank

6)State Bank of India

7)Canara Bank

8)Bank of India

9)Syndicate Bank

10)Indian Bank

Top 10 Private Sector Banks providing MUDRA Loan

1)HDFC Bank

2)IndusInd Bank

3)Axis Bank

4)ICICI Bank

5)Ratnakar Bank

6)Yes Bank

7)Karnataka Bank

8)Karur Vysya Bank

9)South Indian Bank

10)Lakshmi Vilas Bank

Top 10 Regional Rural Banks providing MUDRA Loan

1)Uttar Bihar Gramin Bank

2)Pragathi Krishna Gramin Bank

3)Karnataka Vikas Grameena Bank

4)Kerala Gramin Bank

5)Madhya Bihar Gramin Bank

6)Baroda UP Gramin Bank

7)Baroda Rajasthan Ksethriya Gramin Bank

8)Andhra Pragathi Gramin Bank

9)Pallavan Grama Bank

10)Allahabad UP Gramin Bank