PAN Aadhaar Link - How to Link Aadhar Number With PAN Card Online: A PAN card is a unique 10-character code for India's people, especially those who pay income tax regularly. We can also use it as proof of identification. An Aadhaar card is also proof of identification, such as photo identity, address proof, etc. The aadhaar card can be used as an identification card anywhere in India. So now, if you don't have an Aadhaar and PAN card, you must apply for these cards. In our article, How to Link PAN Card with Aadhaar Card Online, we will explain the procedure and documents required to link your Aadhaar card with a PAN card. There came news last year that all people must connect their PAN card with their Aadhaar card. This will help the government access information quickly.

3) It redirects to another page where you must enter your PAN card and Aadhaar Card and click the validate button.

Link PAN Card with Aadhaar Card Online

How to Link PAN Card with Aadhaar Card Online:

An Aadhaar card is described as a unique identification card in India. The government planned that this card would be linked to every other necessary card, such as a bank, PAN card, etc. This will help the government to access all the information quickly. Nowadays, all government offices are going online as time-saving is very important, and people can use online services easily. So, obviously, only some have an idea about these schemes and how to apply for them. Here, we will tell you how to link your Aadhar card with your PAN card. Read our article How to Link PAN Card with Aadhar Card to get the complete information.

Read Also: Link Voter ID Card with Aadhaar Card Online

Steps to Link PAN Card with Aadhaar Card Online:

1) Visit the Official Website of Income Tax: https://www.incometax.gov.in

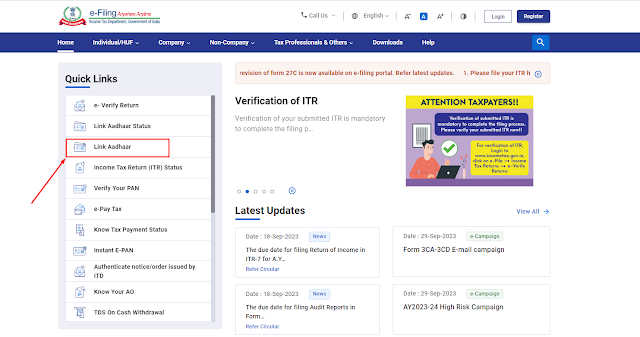

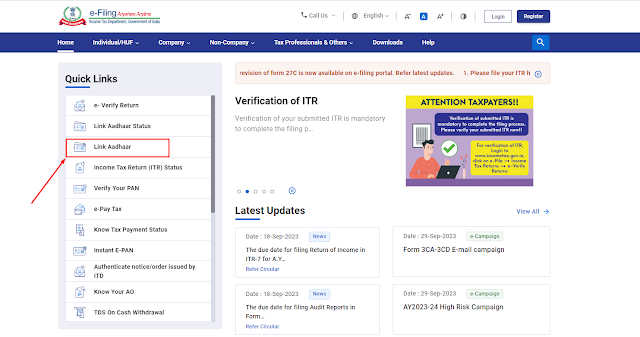

2) To link your Aadhaar on the e-FilinPortalal, you can either visit the homepage and select "Link Aadhaar" in the Quick Links section or login to the e-filinPortalal and choose "Link Aadhaar" in the Profile section.

3) It redirects to another page where you must enter your PAN card and Aadhaar Card and click the validate button.

4) A pop-up window opens on the screen. Click on Continue to Pay Through e-Pay Tax.

5) Enter your PAN Card Number, confirm your PAN Card Number, and your mobile number to receive OTP to your phone.

6) After successful OTP verification, you will be redirected to the e-Pay Tax page.

7) Then click on the "Continue" button. It opens another page. You need to click on Proceed on the income tax title.

8) Choose the appropriate Assessment Year and select "Other Receipts (500)" as the Type of Payment. Click "Continue."

9) The relevant amount will be automatically filled under "Others." Click "Continue."

10) A challan will be generated. Next, choose your preferred payment method. You will be redirected to the bank's website to complete the payment. Return to the e-filinPortalal to link your Aadhaar with your PAN after making the payment.

Track PAN Aadhaar Linking Application Status

1) To check the status of linking your Aadhaar on the e-FilinPortal, go to the homepage, and in the Quick Links section, select "Link Aadhaar Status."

2) Enter your PAN Number and Aadhaar Number and click on the "View Link Aadhaar Status" button

How to Link Aadhaar Card with PAN Card Using SMS:

1) Go to your message option on your mobile.

2) Type UIDPAN<12 Digit Aadhar Number><10 Digit PAN Number>

Example: UIDPAN1234876543219876ABCDEF22XY

3) Send this SMS to 567678 or 56161. And you are done linking your Aadhaar Card with your PAN card.