How to Apply for PAN Card Corrections Online and Offline

In this article, we have provided more about how to apply for correction in PAN card online and offline, how much it will charge, which documents you'll require, and more.

Documents Required:

| ID Proof | Address Proof | DOB Proof |

|---|---|---|

| Aadhaar card | Electric bill | Government-issued ID card |

| Voter ID | Mobile/gas/water bill | Marksheets |

| Driving license | Tax assessment documents | Marriage Certificate |

| Passport | Domicile certificate by Central Government | Pensioners' card |

| Ration card | Aadhaar card | Voter ID |

| Arm's license | Passport | Passport |

| Pensioner's card | Voter ID | Driving license |

| Any other Government-issued ID | Driving license | Aadhaar card |

Steps to Apply PAN Card Corrections Online

Below are the Steps to make corrections in the Pan card online:

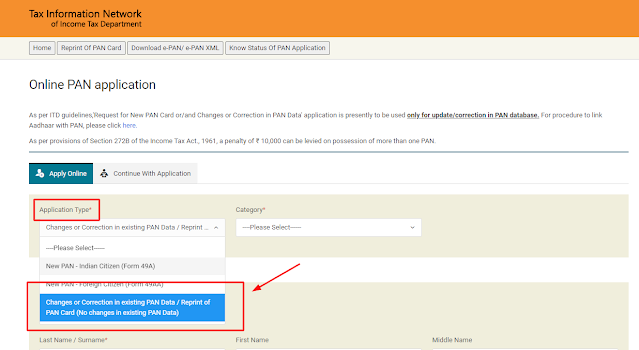

1) Visit the NSDL E-Governance webpage at https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html.

2) Choose "Changes or Correction in existing PAN data/Reprint of PAN Card (No modifications in Existing PAN Data)" from the dropdown under "Application Type" .

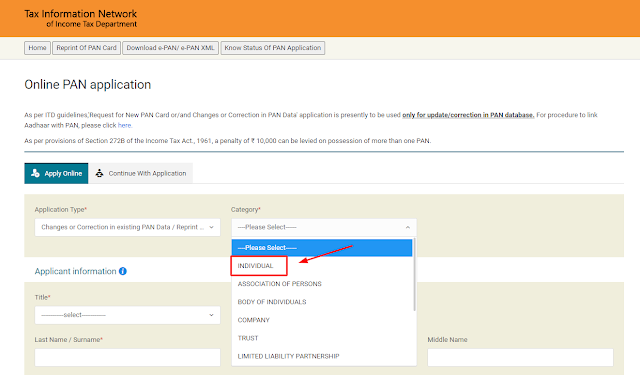

3) Choose the category for the assessee from the "Category" drop-down menu. For example, choose "Individual" from the list if the PAN is in your name.

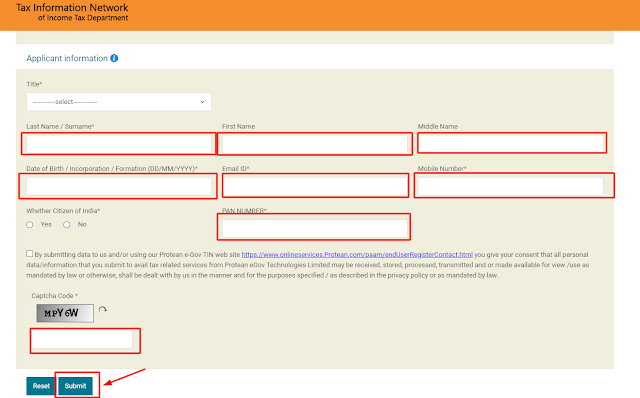

4) enter your name, birth date, email address, mobile number, and PAN number. Fill in the captcha and click "Submit".

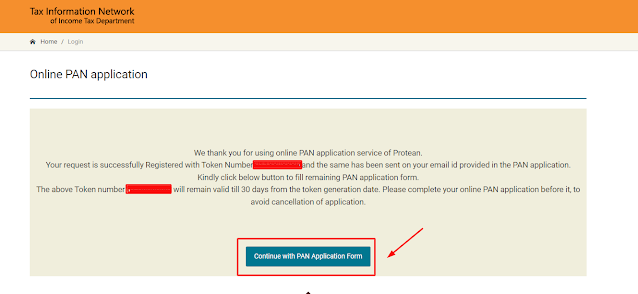

5) Your request will be registered, and you'll get a Token Number at the email address you give. Click the button below it to move forward with the process.

6)After you click "Next," you'll be taken to the form. There are three ways to send in your documents; click "Submit scanned images through e-Sign on NSDL e-gov." Fill in all the required information, like your father's name, mother's name (optional), and Aadhaar number, then click "Next."

7) Now, you will be taken to a new page where you can change your address.

Upload all the required documents, such as proof of address, proof of age, proof of identity, and PAN. You have to sign the declaration and click "Submit."

8) You will be taken to the page where you can pay. Payments can be made by net banking or credit card/debit card.

9) an acknowledgement slip will be printed when the payment is accepted. The applicant should print it and send the physical proof of documents to the NSDL e-gov office. Also, place two photos with space and a sign across the top. Write "Application for PAN Change" on the top of the envelope along with the acknowledgement number.

NSDL Address:

Income Tax PAN Services Unit,

Protean e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk,

Pune – 411 016

Steps to Apply PAN Card Corrections through Offline

1) On the NSDL website, you can get the Request For New PAN Card or/And Changes or Corrections in the PAN Data application form.

2) Fill out the form carefully. Submit the form and required documents to the NSDL collection centre nearest you.

3) After paying the handling fees for PAN card correction, You will get an acknowledgement slip with a 15-digit number.

4) It's important to send the acknowledgement slip to the Tax PAN Services Unit within 15 days of getting it. The address is NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune–411016.

5) Send the relevant assessing officer a letter about your PAN card correction application.