Introduction

PAN number is given to every taxpayer citizen of India. There is a misconception that it is

given to only people above the age of 18. But no age limit is mentioned

by the Income tax department to obtain a PAN card.

Benefits of having a PAN Card for a minor

- A Minor Pan Card is needed when the child's parents are investing in the child's name.

- A minor girl child for whom a Sukanya Samriddi Yojana account is to be opened needs a PAN card.

- A minor child who earns income on his/her own can have a PAN card.

- If a child has a PAN card, parents can name the child as a nominee for their investments.

Documents required

The following Documents are Required to apply for a PAN Card for a Minor :

- Passport

- Aadhaar card

- Municipal birth certificate

- Mark sheet issued by the recognised educational board

How to Apply for PAN card for minors

Parents or guardians of minor children have to apply for PAN card for their children. Applying for a minor PAN card can be completed online or offline.

1) To apply

online for the PAN card, visit the official website.

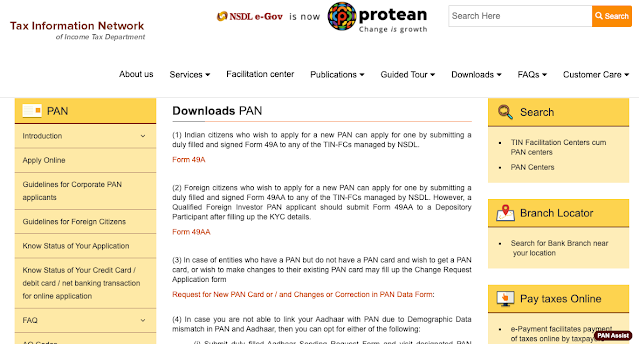

2) there is a drop-down section for Downloads on the page's menu option.

3) Click on this and then click on the PAN option. Based on the resident

type, select 49A or Form 49AA.

4) Applicants are advised to read the instructions carefully.

Now, fill in the required and personal details of the minor. Upload the necessary documents

and also the photograph of the minor.

5) Complete the process by submitting the signature of the parent. Pay the fee and then submit the application.

6) The acknowledgement number generated

can be used to track PAN card application status. The application can also be downloaded from the

website.

7) Fill it out and send it with all the required documents and DD of the fee paid to the

authorities. PAN card will be issued within 10 or 15 days from the date of applying.

| Watch on Youtube | |

|---|---|

| Minor Pan Card Apply Online | https://youtu.be/rERdOTfCX_o |

| Pan Card Corrections Online | https://youtu.be/mIuvvIvLp8E |

| NSDL e-Pan Card Download Online | https://youtu.be/IHJxYLRwnoI |