Guntur Municipal Corporation Property Tax Online Payment Process: Property tax is one of the main ways a city or town gets the money it needs to build and maintain public facilities. So, if you own property in the area where the

Guntur Municipal Corporation is in charge, you must pay the corporation's

property tax. You can still pay the tax the old way, or you can log into the official website of the urban local body to make a digital payment.

Guntur Municipal Corporation Property Tax Online Payment

The government of Andhra Pradesh sets an annual tax on properties in the Guntur Municipal Corporation's area of responsibility. Guntur Municipal Corporation Property tax can be paid personally at the zonal office. Still, more and more property owners are choosing to pay online through the official portal of the urban local body because it is easier. This article gives step-by-step instructions on how to pay your property tax online. It also talks about the other complicated parts of taxation:

Steps to pay Guntur property tax online

Here are the steps on how to pay

Guntur property tax online:

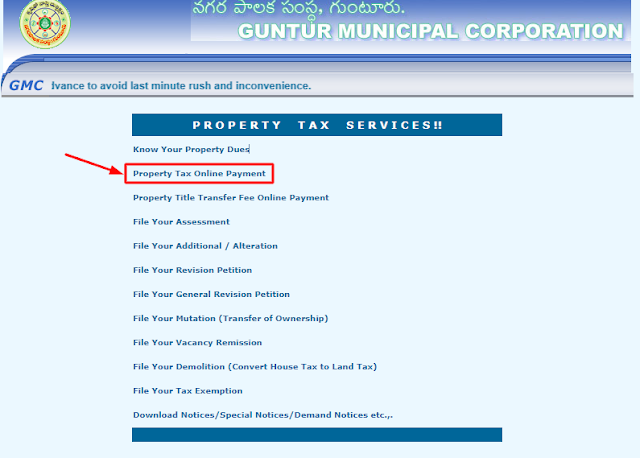

2) Click on "Property Tax Online Payment".

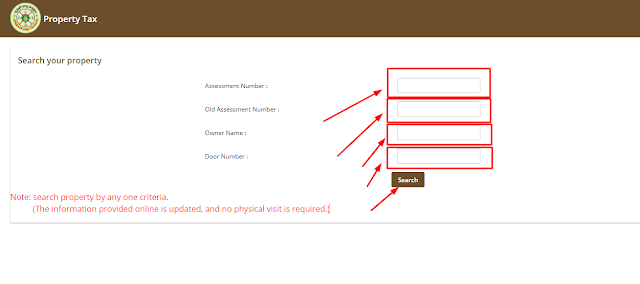

3) Then, it redirects to the "Search your property" page. You must fill in the Assessment Number, Old Assessment Number, Owner Name, and Door Number and click the "search" button.

4) Find out how much tax must be paid. Go to the payment gateway.

5) Choose an appropriate way to pay your taxes online.

6) Follow the steps to finish the transaction. A receipt of acknowledgement will be made. You can save the copy or print it out to use in the future.

Steps to pay Guntur property tax offline

To pay Guntur Property tax offline, you must go to the

local municipal office. Give the information about the property and its owner. Find out how the property tax is calculated using the annual value assessment. Check to determine whether there's anything left to be paid off. When you pay the required amount, you'll get a receipt with the seal of the issuing authority.

Guntur Municipal Corporation Property Tax Online Payment