List of Zones under Chennai Municipal Corporation

| Zone number | Name of the Zone | Ward number |

| I | Thiruvotriyur | 1-14 |

| II | Manali | 15-21 |

| III | Madhavaram | 22-33 |

| IV | Tondiarpet | 34-48 |

| V | Royapuram | 49-63 |

| VI | Thiruvikanagar | 64-78 |

| VII | Ambattur | 79-93 |

| VIII | Anna Nagar | 94-108 |

| IX | Teynampet | 109-126 |

| X | Kodambakkam | 127-142 |

| XI | Valasaravakkam | 143-155 |

| XII | Alandur | 156-167 |

| XIII | Adyar | 170-182 |

| XIV | Perungudi | 168, 169, 183-191 |

| XV | Sholinganallur | 192-200 |

Steps to Pay Chennai Property Tax Online

1) Visit the Property Tax Chennai Official website: https://chennaicorporation.gov.in/

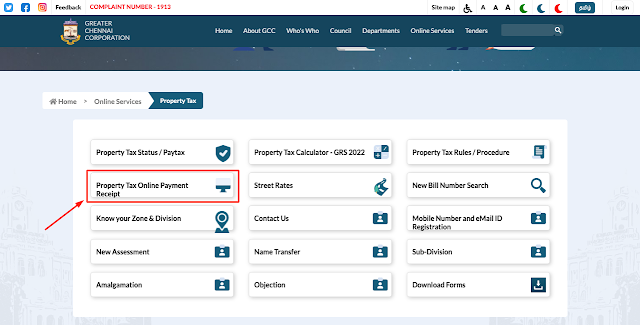

2) Click on "Online Services" on the Home page menu. Then, it redirects to the "Online Services" Page.

3) The "Online Services" page lists all the services. Click on "Property Tax" to access the information

4) It redirects to the "Property Tax" page. To proceed, click on the "Property Tax Online Payment Receipt."

5) It opens the "Property Tax Online Payment Receipt" page. You must select the existing bill number (or) General Revision New Bill Number, enter the zone number, division code, bill Number, and sub no, and click the submit button.

6) The same page below will display the amount and payment option you can pay online.

Steps to Pay Chennai Property Tax Offline

1) The Tamil Nadu State Government has set up E-Seva centers.

2) All of the Taluk offices of the Tamil Nadu Arasu Cable Television Corporation

3) Indian Overseas Bank, City Union Bank, IDBI Bank, Kotak Mahindra Bank, and many others are on the list of Authorized Banks.